德意志银行发布《china eats the world》,到底说了什么?

后附原文。

这不东家在海外的研究团队突然写了篇这研报,中国团队前一天还在想不是要撤么,怎么又eat了,领导赶紧让分析分析啥意思,到底是long还是short啊?于是乎瞎写写,领导还没看,知友先看。

德意志银行(Deutsche Bank)近期发布的《China Eats the World》研报,以“中国的斯普特尼克时刻”为隐喻,系统性论证了中国经济与资本市场的中长期潜力。该报告不仅引发了全球投资者的关注,更从产业升级、政策红利、估值修复等多维度为中国A股的未来投资价值提供了逻辑支撑。以下结合研报核心观点与市场趋势,展开专业分析。

一、估值折价消失:中国资产从洼地到溢价的核心逻辑

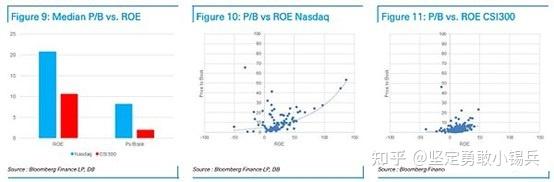

德银指出,当前中国股市的“估值折价”是历史性机遇的核心矛盾。以沪深300指数为例,其市净率(P/B)仅为2.0倍,远低于纳斯达克的8.2倍,而中国企业的股本回报率(ROE)虽低于美国,但其差距远小于估值差异。这种“折价”源于全球投资者对中国经济转型和地缘风险的过度悲观预期。

关键催化因素:

- 产业主导地位的确立:中国在电动汽车、5G/6G通信、绿色能源等领域已占据全球供应链核心地位(如中国拥有全球70%的电动汽车专利),这种技术壁垒的积累将推动企业盈利能力和市场定价权的提升。

- 金融自由化预期:随着中国资本市场开放深化(如QFII额度放宽、跨境结算便利化),外资配置中国资产的渠道更加通畅,叠加A股纳入MSCI等国际指数的权重提升,被动资金流入将加速估值修复。

二、产业崛起:从“制造红利”到“创新溢价”

德银将中国在电动汽车领域的突破比作“斯普特尼克时刻”,强调这是全球资本重新评估中国资产的关键转折点。

结构性优势分析:

- 全产业链闭环:中国已形成从原材料(如锂矿)、零部件(电池、芯片)到整车制造的完整产业链,成本优势叠加技术创新(如DeepSeek AI系统),使中国企业在全球竞争中兼具性价比与高端化能力。

- 服务业的全球化扩张:中国企业在数字经济(如移动支付)、物流(跨境电商)等领域加速出海,服务贸易逆差收窄,进一步拓宽盈利空间。

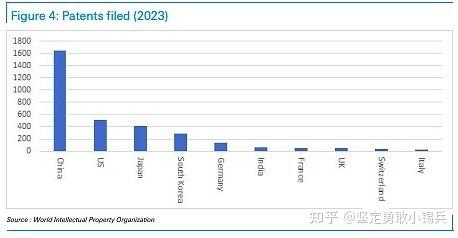

- 政策驱动的技术投入:政府对科技研发的财政支持(如半导体补贴、AI算力基建)与企业研发投入(2023年中国专利申请量占全球近50%)形成正向循环,推动技术密集型产业升级。

三、政策与周期共振:经济复苏的确定性支撑

德银对2025年中国经济复苏持乐观态度,认为财政与货币政策的协同效应将逐步显现。

具体驱动力:

- 消费驱动转型:政策从“生产导向”转向“消费支持”(如减税、消费券发放),内需复苏将带动企业盈利超预期,尤其是消费升级(高端制造、医疗健康)与下沉市场(县域经济)的双向拉动。

- 流动性宽松环境:适度宽松的货币政策(如LPR下调)降低企业融资成本,叠加外资回流(挪威主权基金等机构增配中国资产),A股流动性环境持续改善。

四、全球资本再配置:从低配到超配的必然性

德银数据显示,当前全球基金对中国资产的配置比例处于历史低位,类似于2010年代对化石燃料的“回避期”,而市场终将惩罚这种非理性低估。

配置逻辑转变:

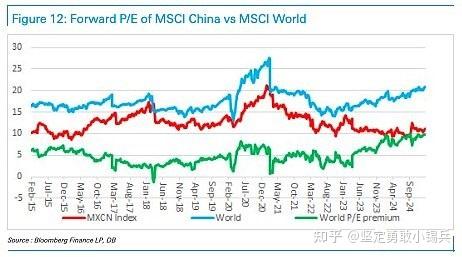

- 风险收益比优势:MSCI中国指数市盈率较全球指数折价达10个百分点,处于历史估值区间底部,安全边际显著。

- 多元化需求:在美股估值高企、地缘冲突加剧的背景下,中国资产与欧美市场的低相关性可有效对冲组合风险。

- 长期增长叙事:中国以超过G7国家两倍的经济增速(尽管基数较高),持续贡献全球经济增长的30%,这一趋势在人口红利(STEM毕业生数量全球领先)与城镇化深化下难以逆转。

五、风险提示与投资策略建议

尽管德银报告高度乐观,但投资者需关注以下风险:

- 短期波动:地缘政治摩擦(如技术出口管制)可能阶段性压制市场情绪;

- 政策执行效果:若财政刺激力度不及预期,经济复苏节奏或放缓。

策略建议:

- 聚焦高护城河行业:电动汽车、清洁能源、半导体设备等领域的龙头公司(如宁德时代、中芯国际);

- 布局港股折价机会:恒生科技指数成分股因流动性折价具备更高弹性;

- 长期持有消费与科技ETF:受益于内需复苏与创新红利的宽基指数。

结语

德银的《China Eats the World》不仅是一份看多报告,更揭示了全球经济权力转移的深层逻辑。中国资产的估值重构并非短期博弈,而是产业升级、政策红利与全球资本再配置的必然结果。对于投资者而言,2025年或是“认知差”收敛的关键窗口期——正如德银所言,“在不推高股价的情况下,将难以获得中国股票的敞口”。

(注:本文分析基于公开研报与市场数据,不构成投资建议;具体操作需结合个人风险偏好与专业顾问意见。)

附全文原文:

China eats the World

This is China's, not AI's, "Sputnik moment"

We believe 2025 will be the year when the investment community realizes that China is surpassing the rest of the world. Increasingly, it is hard to ignore the fact that Chinese companies are offering better value for money, and often higher quality, in multiple manufacturing sectors, and even in an increasing number of service areas.

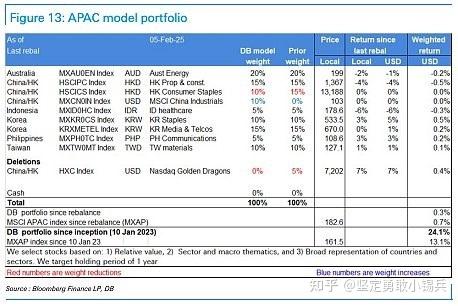

Investors will have to pay the price to be in the driver's seat, and we expect the "China discount" to disappear. Furthermore, as policies tilt towards consumption rather than production, and possibly due to financial liberalization, we believe profitability is likely to exceed expectations throughout the cycle. We believe the bull market in Hong Kong/Chinese stocks will start in 2024 and will exceed previous highs in the medium term.

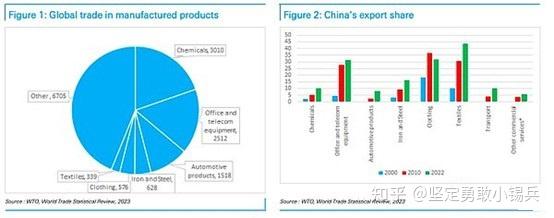

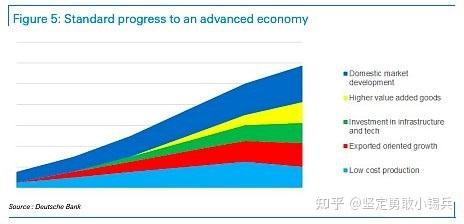

China first emerged as a dominant force in global apparel, textiles, and toys. It then took the lead in basic electronics, steel, and shipbuilding, and more recently in white goods, solar, and other less glamorous areas.

China has also unexpectedly taken the lead in complex telecommunications equipment, nuclear power, defense, and high-speed rail - technological achievements that have not previously been on investors' radar.

But by the end of 2024, China will be in the spotlight for becoming the global leader in car exports, with a flood of advanced, attractive and lower-priced electric vehicles entering global markets.

In 2025, China launched the world's first sixth-generation fighter jet and the low-cost artificial intelligence system "DeepSeek" within a week.

Marc Andreessen called the launch of "DeepSeek" the "Sputnik moment" of AI, but it is more like China's "Sputnik moment", marking the recognition of China's intellectual property rights. China's performance in high-value-added fields and its dominance of the supply chain are expanding at an unprecedented pace.

We believe global investors have been significantly underweight Chinese assets, just as they avoided fossil fuels a few years ago, until the market punished those who made non-market-driven decisions. We see fund exposure to China is currently extremely low. Investors who like to own companies with moats cannot ignore the fact that: the moats now belong to Chinese companies, not the supposedly more economically superior Western companies.

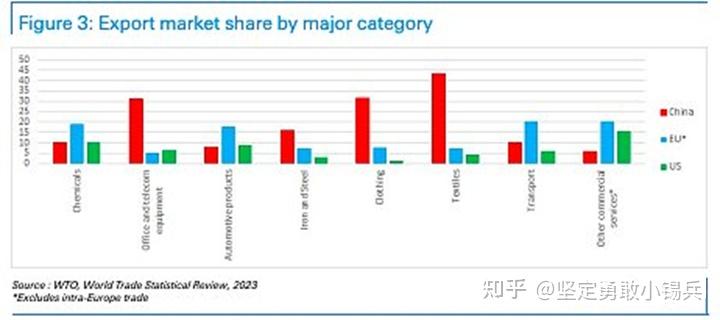

China's manufacturing prowess is evident, with its merchandise exports twice the size of the US. China accounts for 30% of global manufacturing value-added, and its share in services is also rising rapidly. People have avoided China as an investment destination due to concerns about economic weakness, but despite cyclical slowdowns, China's growth rate is still more than double that of most developed markets.

With companies that are leaders in almost every industry, China's share of global market capitalization is unlikely to remain in single digits for long. We believe people are gradually realizing that today's China is akin to Japan in the early 1980s, when Japanese companies were climbing the value chain, producing higher-quality products, and constantly innovating. Many Western companies and industries may face potential existential threats and need to adjust their investment portfolios accordingly.

To survive, Western companies will need to: 1) Automate on a massive scale; and/or 2) Erect trade barriers. The latter path has historically been a downward one for economies, and while this is happening, it may not necessarily help the West. For example, in the auto sector, China's main export markets are often the 7 billion people outside the G10 countries.

Looking at the main categories of international trade, China is present in all categories except apparel (where it dominated before expanding overseas). In key commodity categories, China's scale is larger than the US, and often much larger. The only exception is autos (by value, not volume), but China is likely to have caught up here too - the Ford CEO driving a Xiaomi car makes it hard to see this trend reversing. Even in services, China is catching up, for example gaining around 0.5 percentage points of market share per year in transportation services.

Using Patents as a Proxy for Intellectual Property

China has complete value chains and local industrial clusters in key industries, with multiple Silicon Valley-like specialist domains, and close collaboration with domestic universities on research.

In electric vehicles, China holds around 70% of the patents, and a similar position in 5G and 6G telecom equipment.

In 2023, China accounted for nearly half of global patent applications. Given that the number of Chinese STEM graduates exceeds the total of the rest of the world excluding India, this trend is likely to continue. Furthermore, many of the graduates in other countries are also Chinese. So, barring exceptional circumstances, the rise of Chinese corporate dominance is unlikely to be halted in the near term.

China does face trade barriers, with the US and EU imposing tariffs on electric vehicles being a prominent example, but the West is constrained in its actions by the potentially severe consequences (e.g., inflation, competitiveness decline, and retaliation). In the 1980s, the US tried to curb Japan's rise and had some success, but we believe China's situation today is not like Japan in 1989, but more akin to Japan in the preceding years.

China vs. Japan in the 1980s

Throughout the 1970s, Japan's Gross National Product (GNP) was the second-largest in the world, after the US. Surprisingly, after consulting Wikipedia, we found that Japan's actual GDP growth rate in the 1980s was only around 4% per annum, yet this was still seen as a crucial component of its economic "miracle". In contrast, people today are anxious about whether China's economic growth rate is 4% or 5%, and consider this "slow", but in hindsight, this view may evolve into seeing it as a "miracle".

Here is the English translation of the text, with the specified terms translated as requested:

The Plaza Accord required a 40% appreciation of the yen, which slowed Japan's industrial lead. This led to an economic slowdown, and the Japanese government responded with an accommodative monetary policy. From 1987 to 1989, economic growth recovered to 5%, a period in which the stock market saw a strong rally and a bubble emerged. The recovery in economic growth drove the revival of the steel and construction industries, raising wage levels and increasing employment. In the late 1980s, domestic demand rather than exports became the driver of economic growth. This situation may also occur in China.

Japan in the 1980s

According to the explanation on Wikipedia, Japan's economic growth was achieved through the input of a large amount of cheap labor, the intensive use of capital, and the improvement of productivity. Domestic investment accounted for more than 30% of GDP, and financial repression kept interest rates at a relatively low level, which had a promoting effect on investment. Japan acquired new technologies through joint ventures. In the early 1970s, Japan's savings rate reached 40% of GDP, and by the early 1980s it had dropped to around 30%. In the 1970s, Japan began to set up factories overseas to avoid trade frictions. China has only recently begun to take similar measures.

The question is: what stage is China at on this development path? Like Japan, China has also experienced a real estate bubble, but to a much lesser extent. Furthermore, it has been six years since the credit tightening and the real estate industry began to decline. Housing prices have fallen by a third, mortgage rates have halved, and nominal GDP growth has been about a third, so the affordability of housing has returned to a level not seen in many years. Due to low profit margins and low price-earnings multiples, the stock market valuation is also at a low level. So this is not Japan in 1989 (when the Japanese stock market had grown 50-fold in the previous 20 years).

It is generally believed that China will not follow the consumption-led economic development path of Japan and will only fall into economic stagnation like Japan. In fact, China is on a path that the United States, Japan, Singapore, Hong Kong, Taiwan, South Korea, Spain, and many countries and regions in Eastern Europe have all taken. While some countries and regions are struggling with the middle-income trap, unlike them, China has become the global leader in manufacturing as well as an increasing number of service industries.

Japan achieved financial system liberalization around this time

The 12th chapter of the IMF's 2013 report "China's Economic Transformation" mentions that Japan in the 1980s has similarities with China's future development path. Before the Plaza Accord, Japan's financial system was highly regulated, with interest rates controlled and capital controls strict, and due to the abundance of corporate funds, the demand for bank credit was limited. Japanese investors held a large amount of US assets, and the depreciation of the yen also led to calls from abroad for Japan to open up its financial markets and increase the attractiveness of yen-denominated assets. This in turn led to capital inflows into Japan, increasing the money supply and driving economic growth and asset bubbles.

China may also be heading in a similar direction. President Trump may emulate President Reagan's approach and push for China's financial liberalization in trade agreements, and China may also be preparing to accelerate the internationalization of the renminbi. We believe this is good news for the stock market, as the renminbi may depreciate, which from a foreign exchange perspective will boost corporate profitability and the attractiveness of Chinese assets. Why does the US want to push for this? The reasons may include: 1) political considerations in reaching an agreement; 2) believing that renminbi depreciation can offset the impact of tariffs, allowing trade to continue and tariffs to be collected, rather than being crowded out; 3) believing that financial liberalization will lead to renminbi appreciation, thereby weakening China's competitiveness.

Regardless of external pressure, if China wants to promote consumption, financial system liberalization will be helpful, by normalizing interest rates and ending the transfer of wealth from savers to enterprises. This will reduce over-investment and vicious competition, as capital will be allocated more rationally, which will be conducive to improving corporate profitability, easing fiscal pressure, as the returns of state-owned enterprises will increase. We expect large enterprises, investment companies and households to increasingly pressure the government to ease vicious competition to boost stock market value. Just as the government previously slowed down excessive investment in infrastructure and real estate, curbing industrial over-investment will obviously be the next step, and it may come faster than expected. We expect this to become a key issue in 2025, both to appease the US and as a necessity of the situation, and we expect this to drive a major bull market.

But what is the impact of China's population decline?

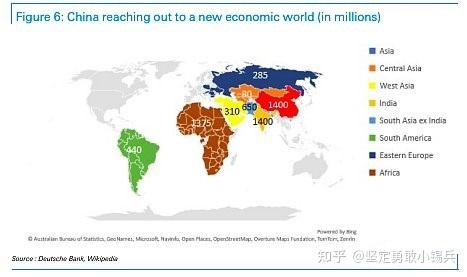

The decline in China's population is a drag on economic growth, but many countries are facing this problem. We believe this completely ignores an important fact: China has two advantages: 1) leading in automation, with about 70% of the world's industrial robots installed in China, bringing productivity advantages and thus increasing per capita wealth; 2) a huge potential market, with the "Belt and Road" initiative incorporating Central Asia, West Asia, the Middle East and North Africa into its development trajectory, expanding market potential.

Although Central Asia has a population of only 80 million, it is rich in resources; West Asia has a population of 310 million and is generally prosperous. South Asia has a population of 2.1 billion (although two-thirds of it is in India, which has largely restricted trade and investment with China, but this situation may change in the medium term). There is also Africa, with a population of 1.4 billion. In other words, the potential consumer population of Africa is comparable to that of China, and the potential consumer population of Central Asia, West Asia and South Asia (excluding India) is comparable to that of ASEAN plus Latin America. If China-India relations improve, India's potential consumer population will also become a huge market. Therefore, focusing only on China's domestic population situation may lead to erroneous conclusions about China's future.

In 2024, China's exports grew by 7%, with exports to Brazil, the UAE and Saudi Arabia growing by 23%, 19% and 18% respectively, and exports to ASEAN countries along the "Belt and Road" growing by 13%. Currently, China's exports to ASEAN plus the BRICS countries are on par with its exports to the US plus the EU, and its market share in these destinations has increased by nearly two percentage points per year over the past five years. Even in Latin America, China is rapidly expanding its market. Therefore, although US tariffs will hurt China, Deutsche Bank's economic team believes that if the US imposes 10% tariffs in the first half and second half of the year respectively, given that US exports account for 3% of China's GDP, this will put 0.5% downward pressure on China's GDP, which is a manageable shock.

The downside of China's export dominance is that many major countries, even within the BRICS+ group, have adopted protectionist measures, so China's export growth is to some extent constrained. However, due to its advantages in intellectual property and manufacturing value-added, Chinese companies are likely to expand their influence in the international market by setting up factories in other markets or exporting components for assembly. The weaponization of the US dollar makes investing in overseas infrastructure and factories more attractive than investing in US Treasuries, so the future direction of development is quite clear.

The China-US trade issue may see an unexpected positive turn

The market generally expects the US tariff level on China to be higher than Deutsche Bank's expectation (we expect 20% tariffs to be implemented in two steps by 2025, one of which has already been announced). But the actual situation may be much more optimistic than this pessimistic expectation.

Here is the English translation:

The Trump administration appears to be keen on using tariffs as a source of fiscal revenue, and for economic and strategic reasons, views China as the main source of tariff revenue. However, President Trump seems to value tactical victories more than clinging to ideological positions that are difficult to gain support for. In our industry, there are investors as well as traders. In recent years, the influence of traders has been growing. Perhaps President Trump is more like a political "trader" than an "investor" who adheres to an ideological stance. If so, he is likely to set strict stop-loss points.

"DeepSeek" has shattered the West's illusion of being able to contain China. The best approach for the US would be to stimulate business development through deregulation, providing cheap energy, and reducing import barriers for intermediate products that cannot be competitively produced domestically. The last point may take longer to achieve, but we expect that members of the US House, Senate, and business leaders will generate internal demands that will push the US to return to the traditional Republican stance on trade issues. This may require some back-and-forth negotiations, but this analyst expects that a more trade-friendly stance will ultimately become part of the "America First" agenda before the midterm elections.

We believe that a political "trader" will seek to lock in results as soon as possible, and therefore may reach a US-China trade agreement in the first half of 2025, then shift focus to Western Hemisphere affairs. A quickly reached agreement may include limited tariffs (as expected by Deutsche Bank), the removal of some existing restrictions, and some major contracts between Chinese and US companies. If this occurs (which this analyst believes it will), the Chinese stock market is expected to see an upswing.

Trade and Market Performance Are Not Closely Correlated

Historically, trade and economic strength have been mutually reinforcing. Therefore, we were surprised to find that there is little research linking exports to stock market performance. However, China's exports are closely related to the growth in global money supply, which has been rising but is now slowing down. When we prompted Deutsche Bank's AI platform to search for relevant research, it told us: "Some studies suggest that export growth can increase corporate earnings and thus boost stock valuations... (but) some research also indicates that a sole focus on export growth may sometimes come at the expense of domestic demand, which could hinder overall economic growth and thus negatively impact the stock market."

Paradoxically, a decline in exports may actually drive stock market gains in the short term. China's rise across various industries has been accompanied by over-investment in many areas. In the solar energy sector, there are currently efforts to reduce supply, and if other industries follow suit, this could be positive news for the stock market, as it may also release some capital for domestic consumption.

The growth rate of Chinese household deposits has slowed to twice the nominal GDP growth rate, but since 2020, Chinese household savings have increased by $10 trillion, and we expect these savings to be largely used for consumption and investment in the stock market in the medium term. Therefore, Hong Kong/Chinese stocks have significant upside potential in terms of accelerating earnings growth and P/E revaluation.

Valuing Market Leaders

The problem with investing in the technology sector is that profits are often concentrated in the hands of market leaders, leading to fierce competition to capture this position. Chinese investors are fully aware of this issue, but leading tech stocks like Amazon have faced similar situations. When comparing the SSE 300 index and the Nasdaq index, both of which contain the global leaders in their respective domains, we find that the ROE of US companies is twice that of Chinese companies, but investors pay a P/B ratio for US companies that is four times higher (8.2x vs. 2.0x). Most large-cap Chinese stocks are also listed in Hong Kong, where their share prices are typically around 40% cheaper, close to a 1x P/B ratio. Looking at the MSCI China index, it trades at a record 10 percentage point discount to the world index in terms of P/E, and is also near the bottom of its valuation range.

As Chinese companies expand globally, this valuation discount should eventually turn into a premium at some point. We believe that investors must significantly shift towards investing in Chinese stocks in the medium term, and may have difficulty obtaining these stocks if they do not push up their prices. We have been bullish on the Chinese stock market, but have previously been constrained in finding the factor that would awaken the world and lead to buying Chinese stocks, and we believe that China's "Sputnik moment" (or its dominance in the electric vehicle sector, for example) is that factor. We expect the Hong Kong/Chinese stock market to continue outperforming in the medium term, just as it did in 2024.

想提高自己的自取,持续更新

专栏:

小锡兵说缠小锡兵带你读《缠论》原著108篇全【读过才推荐系列】炒股精选书籍40本精选回答:

坚定勇敢小锡兵:【读过才推荐系列】炒股精选40本书籍——买书学习花钱强过无知炒股亏钱男子用 87 个账户投入逾 19 亿操纵股价获利超 9000 万元,被罚 2.71亿元,如何看待此事?为什么绝大多数的人都学不会缠论?如何看待证监会发布2024年1号处罚决定书? - 知乎 (zhihu.com)

缠论中枢结构中的反向扩张 - 知乎 (zhihu.com)

对于高频交易为什么能持久存在这个问题,你怎么看? - 知乎 (zhihu.com)

为什么散户赚不到钱?有哪些误区?——从操盘手培训看散户心理/行为学 - 知乎 (zhihu.com)

证监会发文,调降基金股票交易佣金费率,降低基金管理人证券交易佣金分配比例上限,有何影响?如何解读? - 知乎 (zhihu.com)

如何构建属于自己的股票交易系统(持续更新,4月12日更新) - 知乎 (zhihu.com)

绝大部分人都用错了!机构如何用筹码峰?不为人知的技巧 - 知乎 (zhihu.com)

炒股中“黄金分割”是什么?到底靠不靠谱?——带你深入了解“黄金分割”使用的底层逻辑,以及市场上不为人知的用法 - 知乎 (zhihu.com)

请问各位老师,为什么市场中有“横有多长竖有多高”的说法呢,为什么这么说呢? - 知乎 (zhihu.com)

股票涨跌的原理是什么? - 知乎 (zhihu.com)

最后祝大家在2025年投资事业双丰收!

以上内容不构成投资建议,股市有风险,投资需谨慎。

如果喜欢,请点赞+收藏+关注,

持续不断的每日复盘+更多干货分享。